Key Points

- Landed cost is used to calculate a business’s expenditures, which can inform its profitability and help it with pricing strategies.

- Landed cost includes all the costs associated with shipping a product from the manufacturer to the merchant, in addition to the product price. These costs can vary depending on the country.

- Landed cost excludes SG&A costs, operating expenses, such as marketing and advertising, marketplace fees, research and development, returns and refunds, and customer service costs.

- Using Descartes Sellercloud, ecommerce sellers can calculate landed costs and other expenses and make adjustments.

Not understanding and failing to track your expenses is a major threat to your business. In many cases, not managing finances can kill an up-and-coming business.

According to an Entrepreneur article by Timothy Carter, 20% of businesses fail in their first year, and 50% fail in their first five years. Furthermore, according to a study by US Bank, 82% of US businesses fail because of poor cash flow management. That’s why you must fully understand expenses like landed cost—your business depends on it.

In this article, we’ll explain everything you need to know about landed cost, including what it includes and excludes, how to calculate it, and how it can help your ecommerce business.

Are you lost in a minefield of ecommerce phrases? Then you need this blog post: 53 Essential Ecommerce Acronyms You Must Know and Understand.

What Is Landed Cost?

Landed cost is the sum of all the costs associated with shipping a product internationally from your vendor’s warehouse to you, including the product price. When you import a product from abroad, there are customs fees and other fees that can vary. For example, importing from Asia can incur various fees depending on which country you import from. Calculating landed cost helps companies make informed decisions about their pricing strategies, optimize supply chain operations, and improve their profit margins.

The term ‘landed cost’ originates from international trade and commerce. The final destination, or ‘land,’ refers to the buyer’s location. Landed cost can also be called the ‘total landed cost.’ ‘Landed cost’ became a common term in global trade where goods travel across borders, involving various expenses beyond the purchase price.

Landed Cost Includes:

Any cost of transporting a product from a vendor to the seller can be considered a landed cost. Here are the most common:

- Customs fees—A charge for products crossing an international border.

- Duties—A tax levied on imported and exported goods, usually according to product value or quantity.

- Tariffs—Can be imposed on imported goods to control trade or protect an industry.

- Insurance—Covers potential losses or damages when goods are in transit.

- Shipping and freight costs—Costs associated with transporting goods to their destination.

- Crating—A charge for packaging goods into crates or containers to protect them during transit.

- Handling fees—A charge for the labor and services involved in managing and moving goods during the shipping process.

- Payment fees—A charge to handle payments. They may differ depending on the payment method.

- Product price—The cost of the product itself.

Plus, any other additional costs incurred on the way to the merchant. These can even include expenses like FBA inbound shipping if you send it to an Amazon fulfillment center from overseas.

Landed Cost Excludes:

Landed cost excludes costs unrelated to the journey products take to merchants. Any costs considered SG&A (‘Selling, General, and Administrative expenses) or OPEX (Operating Expenses) are not included in landed cost calculations. For example, the following costs are either SG&A or OPEX and are excluded from landed cost calculations:

- Marketing and advertising—Costs related to product promotion and marketing are excluded from landed costs.

- Warehouse storage costs—The costs associated with storing the product at your warehouse before being shipped to a customer.

- Post-sales support and warranty costs—The costs associated with providing post-sales support, warranties, and repairs are not included in the landed cost.

- Research and development and design costs—Any costs associated with researching, developing, and designing products are excluded.

- Admin costs—Costs related to keeping your business running.

It’s also important to highlight the difference between landed cost and ‘first cost.’ First cost is the price paid to the manufacturer—it includes only the price of the product and excludes all shipping costs. Landed cost, on the other hand, includes the product price and shipping.

How to Calculate Landed Cost?

Before we explain how to calculate landed cost, remember that the formula provides you with an estimation—it won’t necessarily be accurate. Calculating landed cost involves many factors, which add an additional layer of complexity. Furthermore, some of these variables are subject to change. In 2018, for example, the US-China trade war saw the two countries slap enormous tariffs and other trade barriers on each other that dramatically increased landed costs.

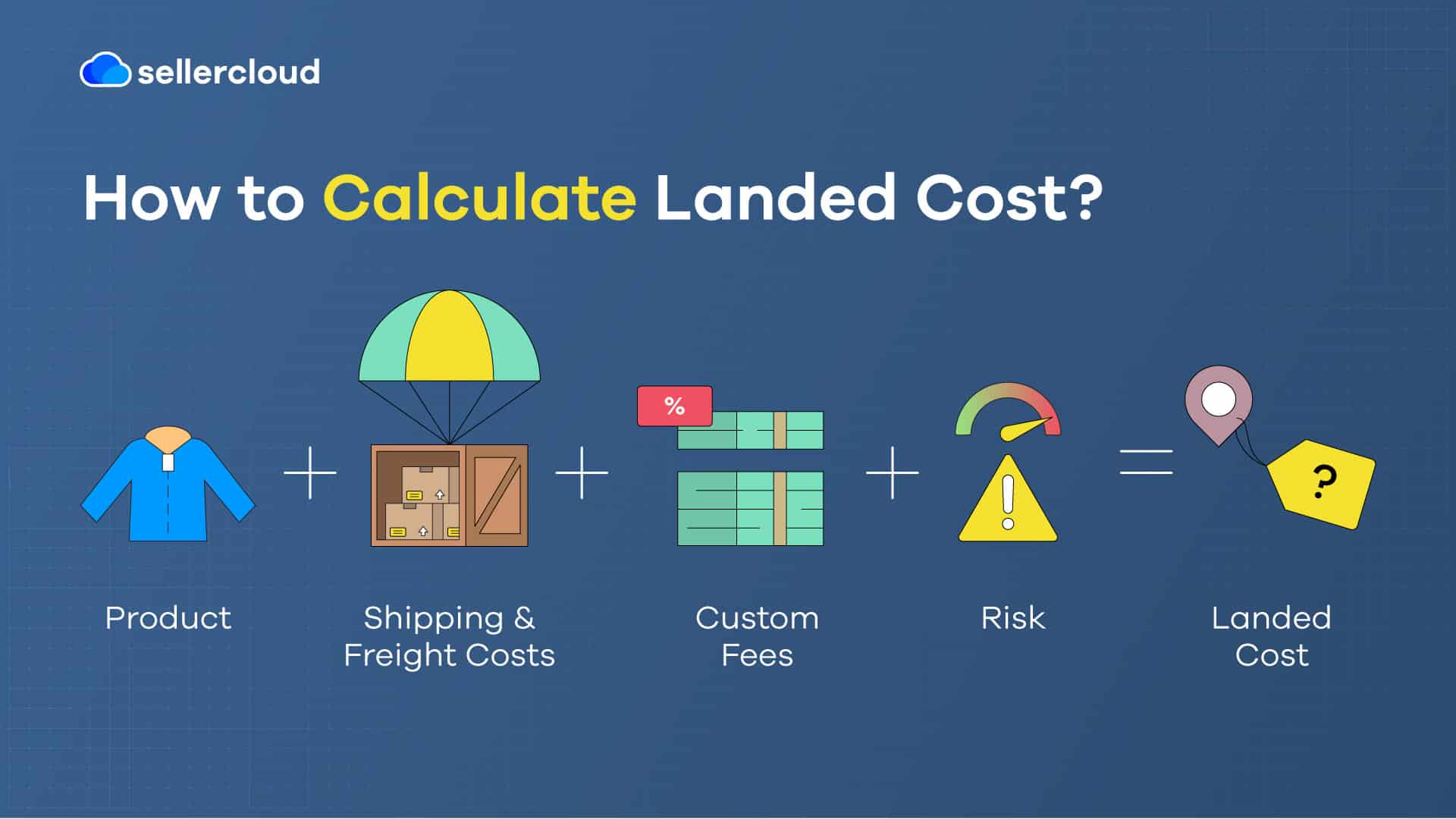

Here’s the formula for calculating landed cost:

Product + Shipping & Freight costs + Custom fees + Risk = Landed cost

(Risk = insurance, compliance, safety stock, etc. Neglecting these expenses is risky because you could lose your inventory if something goes wrong.)

To estimate your landed costs, you should use software to automate your calculations. Automating landed costs is faster, more accurate, and reduces errors. This is especially important for companies selling abroad because automation reduces the complexity of calculating the fees involved.

How Is Landed Cost Useful?

Getting landed costs right is essential for profitability. By tracking landed costs, companies can establish product pricing as they can determine the actual margin between the cost of acquiring a product and the price they will charge customers.

If your landed costs are high, your products will be more expensive to consumers as you will need to increase the sale price to cover these expenses. Customers may then avoid your products and look for cheaper alternatives elsewhere.

On the other hand, estimating costs too low can harm your profit margins and even cause a loss without your knowledge. Examining your landed cost may reveal that your current business model is not sustainable or that lowering costs (if they are too high) can increase sales.

Understanding landed cost is also beneficial when there is a supply chain disruption. Correctly calculating landed costs can help companies react and reduce the risk of volatile costs impacting their operations. This also gives them an advantage over their competitors, who might not be so savvy. Companies with a poor understanding of landed costs can be hit hard when the market is volatile and may even go out of business.

How Can Analyzing Landed Cost Help Businesses?

On a basic level, landed cost can inform business owners if they are profitable, where they can potentially make savings, and help them with financial reporting. When businesses break down their landed cost, they can see where their most significant expenses come from and work toward controlling and reducing them.

Companies that don’t monitor cost calculations, such as landed cost, are more likely to encounter unexpected financial troubles. A stable business regularly stays on top of its costs and takes advantage of where they can be reduced. The money you make from a sale must cover the product and all associated costs. Only then can you accurately calculate revenue.

You may find that you need to increase your prices or reduce certain parts of the process. A company should have a strategy for reducing landed costs when it begins to harm its margins. Though relatively simple to calculate, you need software to keep on top of landed costs properly. When you delegate landed cost monitoring to software, you reduce the possibility of being caught off guard by unexpected volatile costs.

Software can monitor landed costs non-stop, set alerts when they reach a certain threshold, automate actions, visualize trends, and assist with reporting. These benefits are advantageous if you have hundreds of SKUs to monitor and a high sales volume.

How Can Descartes Sellercloud Help Calculate Landed Cost?

Descartes Sellercloud’s omnichannel ecommerce platform centralizes all your cost calculations, including landed costs, into one interface, increasing your financial visibility. Descartes Sellercloud tracks the costs of items, shipping, duties, and freight on the way to sellers, making land cost calculations easier.

However, that’s just the beginning. Descartes Sellercloud can also adjust product cost for margin calculations. This allows you to calculate the average cost per unit to reflect the total landed cost instead of the average cost being only the base unit cost. Plus, you can utilize a range of accounting integrations, such as QuickBooks, to help and request customized plugins to help you, and use other reporting features.

Request a demo today and see how Descartes Sellercloud can help you manage your ecommerce business expenses.

Landed Cost FAQs

Why Is Landed Cost Important for Ecommerce Sellers?

Landed cost helps you understand the true cost of acquiring your products. When you know every expense involved—from product price to duties and freight—you can set accurate prices, improve margins, and avoid unexpected losses. It also helps you adjust your strategy when market conditions change.

Is Landed Cost the Same as First Cost?

No. First cost refers only to the price paid to the manufacturer. Landed cost includes the product price plus all expenses required to ship the product from your vendor to your warehouse, such as customs fees, shipping, insurance, and tariffs.

How Can Sellercloud Help Me Track and Calculate Landed Costs?

Descartes Sellercloud centralizes your cost data so you can track product, shipping, duty, and freight expenses in one place. It also lets you adjust item costs for accurate margin calculations and integrates with accounting systems to simplify reporting.