Tax is never fun, and sales tax is the least exciting of all. Online sellers loathe it. It’s irritatingly complicated and massively time-consuming. However, spending some time to understand why we pay sales tax and how it works between different states and tax jurisdictions will somewhat ease the burden.

In this article, we’ll go through everything you wanted to know about US sales tax but were afraid to ask.

What Is Sales Tax and Why Is It Such a Big Deal in The US?

Sales tax is the tax sellers charge consumers when a product is sold. The seller must then pay this tax to the state or jurisdiction that imposes it. It can be a thorny issue in the US because many Americans fiercely oppose the idea of a federal sales tax.

As a result, the US has some of the most complex sales tax in the world, with many levels (state, local, and city) and percentages depending on where in the country the sale is made.

Since 2018, sales tax for ecommerce has become much more complicated to calculate for ‘out-of-state’ vendors (vendors without a physical presence in the state where a product is sold). It all started when South Dakota v. Wayfair, Inc. overturned the 1992 Quill Corp. v. North Dakota Supreme Court Ruling.

During Quill (1992-2018), when online sellers made out-of-state sales, they didn’t have to pay sales tax to the state where the sale occurred (where the buyer lives). In 2018, South Dakota v. Wayfair, Inc. overturned Quill Corp. v. North Dakota, completely changing how sales tax works for ecommerce in much of the US.

At the time of the case, South Dakota argued that brick-and-mortar businesses were losing out to rapidly growing ecommerce companies. Ecommerce stores didn’t have to pay out-of-state sales tax, which meant they could charge buyers less, giving them an unfair competitive advantage.

So, South Dakota passed a bill that forced out-of-state sellers to pay sales tax when orders were shipped to their state and told online retailers to comply. However, Wayfair and a few other online retailers argued that they didn’t have to comply with this rule because of Quill. Legal action ensued, going all the way to the Supreme Court.

In court, South Dakota also argued that mail-order sales, particularly from ecommerce companies, had grown enormously since Quill Corp. v. North Dakota in 1992 because of the internet.

According to the US Department of Commerce, total ecommerce sales in the US were estimated at $513.6 billion in 2018 and accounted for 9.7% of total sales. Unsurprisingly, this number was only going to grow.

According to data from Statista, revenue from US ecommerce is estimated to be $905 billion in 2022. In 2023, it is estimated to cross $1 trillion, and by 2027, it could exceed $1.7 trillion. It meant that states were losing billions in tax dollars.

On the other hand, Wayfair’s best argument was that collecting sales tax on a state level would greatly complicate tax payments. They explained that 45 states (plus the District of Columbia, Puerto Rico, and Guam) and many local jurisdictions collect sales tax.

Furthermore, each tax jurisdiction has varying laws on what products are exempt and what rates are charged. In the end, South Dakota won, Quill was overturned, and many states decided to follow suit and charge out-of-state sellers sales tax. What choice did Sellers have but to comply?

How to Calculate Sales Tax

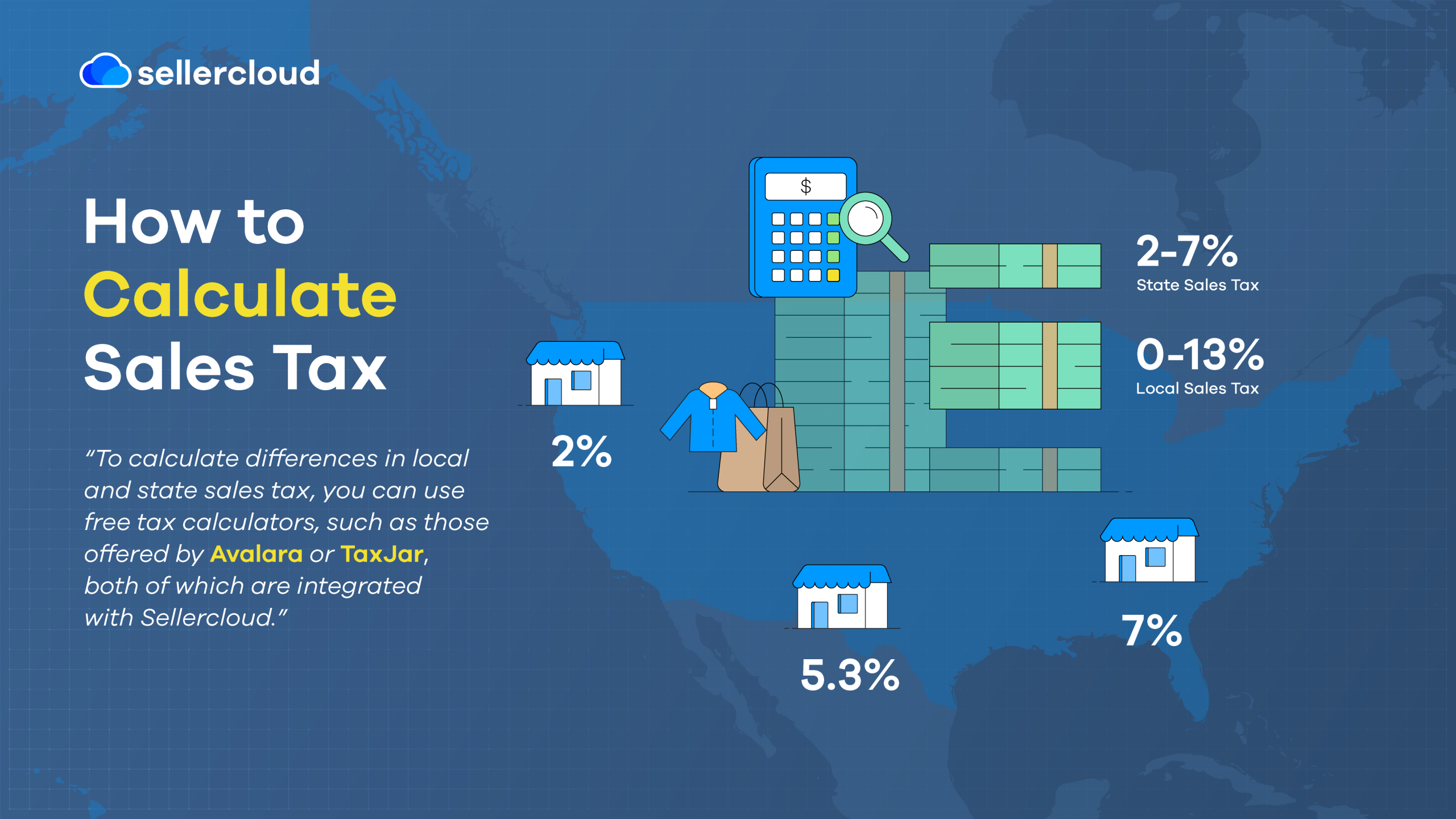

According to data from the World Population Review, sellers can expect a sales tax of between 4% and 7% in most states, with the average state sales tax being 5.09%.

California has the highest state tax as of 2023, at 7.25%, while Indiana, Mississippi, Rhode Island, and Tennessee also charge a 7% state sales tax. At the other end of the spectrum, of the states that charge sales tax, Colorado has the lowest rate at 2.9%.

However, it’s not just states that charge sales tax—there are local jurisdictions, too. According to Avalara, there are over 13,000 tax jurisdictions in the US, and many charge more than 7%. For example, in Alabama, while the state sales tax is 4%, local sales tax can increase to 13.5%.

Some of the highest local sales taxes are in New Jersey, with the maximum reaching 12.63% (the highest in the country). This local sales tax is added to the state sales tax.

If we use Washington state as an example, the sales tax could be as high as 16.9% when you combine the state sales tax of 6.5% with the maximum local or city rate of 10.4%. A $10.00 product can become $11.69 when you add the 16.9% sales tax.

Pro tip: To calculate differences in local and state sales tax, you can use tax calculators, such as those offered by Avalara or TaxJar, which are integrated with Descartes Sellercloud.

Another problem is that sales tax changes often and will continue to change. Sales taxes can increase or decrease, new sales taxes can be introduced, and old ones can be made obsolete. Tax compliance tools, such as Avalara’s AvaTax (part of Descartes Sellercloud’s long list of integrations), are valuable when calculating sales tax.

They automate much of the work and stay current with the latest changes. Such software can help reduce mistakes and save time for other tasks.

What States Don’t Have Sales Taxes?

Alaska, Delaware, Montana, New Hampshire, and Oregon are the only five states that don’t charge sales tax. However, this can be misleading because, on a local scale, additional taxes can still be piled on. For example, though Alaska has a 0% state sales tax, locally, a sales tax of up to 7% can be levied depending on where you ship to within the state.

Who Needs to Worry About Sales Tax?

Most states follow South Dakota’s model, which requires sales tax from vendors that either make more than 200 shipments to their state or if those shipments exceed $100,000 in revenue. So, if you’re an online merchant reaching those levels, you should use a service like Descartes Sellercloud and Avalara’s AvaTax to handle shipments and accounting properly.

If you’re not at that point, you don’t need to worry about it (yet). However, adopting such software will become increasingly important as you scale. Incorrectly charging sales tax on a large scale can snowball into a major issue.

Book a demo with Descartes Sellercloud today to discover how we can help you manage your ecommerce operations.