When an order comes in, which stock do you use to fill the order? Do you pull from your oldest stock first (FIFO – first-in-first-out) or your newest inventory arrivals (LIFO – last-in-first-out)?

Inventory planning is something you have to get right as an omnichannel ecommerce seller. While your warehousing workflows and inventory counts must be reliable and accurate to ensure maximum logistical efficiency, these practices also play a major role in your cost accounting.

How you select stock to fulfill orders has a direct effect on your inventory valuation. Consequently, the method you choose will also have a major impact on your ecommerce business at tax time.

So, which style of inventory valuation is better? Like most things in the ecommerce industry, the answer is, ‘it depends.’ Many factors go into making the optimal choice between FIFO and LIFO for your brand and business.

Some of the most common reasons for choosing one over the other are:

- Product type.

- Inflationary conditions.

- Market values.

- Tax implications.

In some cases, one style of inventory valuation model may be the optimal choice for your brand forever. In others, you may shift between the two approaches depending on financial and market conditions.

That said, regulations and procedural hurdles must be considered when making (or changing) inventory recording decisions. In some cases, making the wrong decision can seriously cost you.

The First-In-First-Out (FIFO) Inventory Management Strategy

For most businesses, FIFO is the preferred inventory valuation model. Whatever stock is purchased first is the first to be sold. Your COGS (Cost Of Goods Sold) and balance sheets are tabulated accordingly.

For example, say you purchase 50 units of a product in January for $1 per unit. In March, you purchase an additional 50 units of the same product for $2 per unit. In April, you fulfill a customer’s order for 60 units.

The FIFO accounting method dictates that you sell the 50 units you purchased in January and the 10 units you purchased in March. This leaves you with 40 units purchased at the $2 per unit rate and a remaining total inventory value of $80.

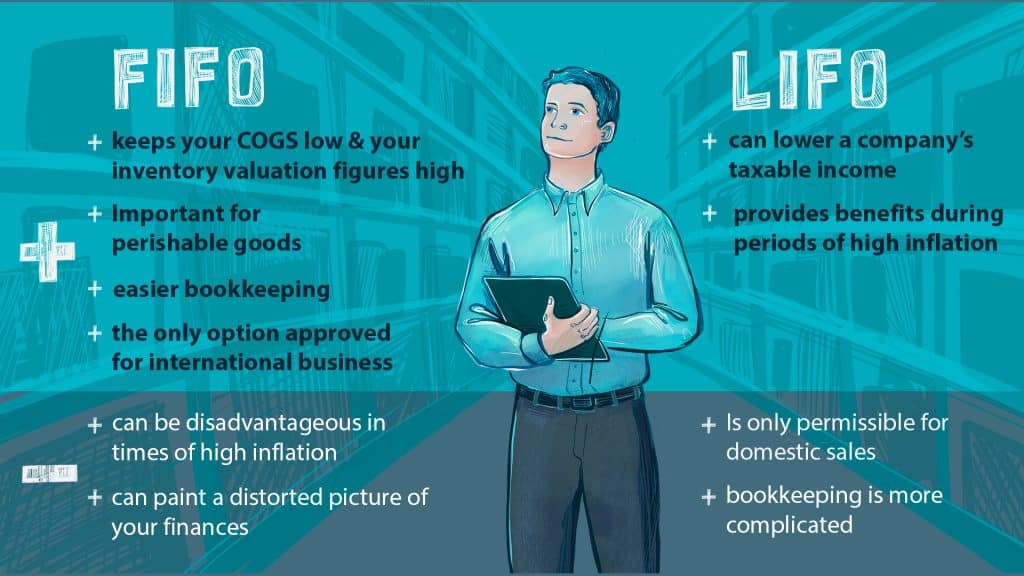

FIFO Pros

There are many reasons why you should opt for a FIFO inventory reporting style:

FIFO Typically Keeps Your Cogs as Low as Possible While Keeping Your Inventory Valuation Figures High

This means optimizing your profit-per-sale while maximizing the value of your unsold inventory for tax reporting. This is especially true in times of economic deflation. While this may not always result in the lowest possible tax bill, it typically demonstrates the profitability and economic solvency that banks and investors like to see.

FIFO Is Particularly Important for Perishable Goods

Perishable goods can become unsellable dead stock if left on your warehouse shelves for too long. With this approach, you can be sure that the inventory on hand is always the newest and freshest.

FIFO Bookkeeping Is More Straightforward than LIFO

Simply put, there is less likelihood of error or increased IRS scrutiny with FIFO recordkeeping.

FIFO Is the Only Inventory Valuation Model That Can Be Used for International Business

If your ecommerce business sells overseas, LIFO is not an option. The International Financial Reporting Standards (IFRS) strictly prohibit LIFO.

FIFO Cons

Despite its benefits, FIFO is not always the best option from an accounting perspective.

FIFO Can Be Disadvantageous in Times of High Inflation

When your oldest stock is more expensive than your newest, you inevitably face higher COGS rates and lower inventory valuation figures. This can be helpful from a tax perspective, but it has a definite negative impact on your overall profitability ratios.

FIFO Can Paint a Distorted Picture of Your Finances

Particularly if you deal in rapidly fluctuating markets and/or carry significant amounts of inventory, the prices used to calculate your COGS in a FIFO model may reflect significantly different costs than what you currently pay.

The Last-In-First-Out (LIFO) Inventory Management Strategy

Harkening back to the previous example, if you fulfill the same customer’s order for 60 units using the LIFO accounting method, you would start by selling off 50 units from your $2 per unit March purchase and 10 units from the $1 per unit January purchase. This leaves you with 40 units purchased at the $1 rate and a remaining total inventory value of $40.

In this instance, the LIFO model provides a more favorable tax benefit as you have both reduced the value of your inventory on hand while also reducing your profit margins. However, had the costs of the January and March inventory purchases been reversed, LIFO accounting would have resulted in a greater profit margin and a higher tax liability.

One of the largest benefits of LIFO is that, particularly in times of high inflation, selling off higher-valued recent inventory first produces more favorable accounting results.

LIFO Pros

LIFO Can Lower a Company’s Taxable Income

When newer products purchased at a higher rate are sold first, COGS rates rise, and profit margins shrink. This reduces your net income and, in turn, your business’s tax liability.

LIFO Provides Benefits during Periods of High Economic Inflation

Purchasing new inventory at higher and higher rates hurts your bottom line, but the problem is exacerbated when you are paying taxes on COGS calculations relying on older, lower-priced inventory. The LIFO model can provide some relief against these types of inflationary issues.

LIFO Cons

LIFO Is Only Permissible for Domestic Sales

As previously mentioned, the International Financial Reporting Standards (IFRS) do not allow LIFO inventory reporting. If your ecommerce business currently sells overseas or if you plan on extending your business overseas in the near future, do not use LIFO.

LIFO Creates a More Complicated Bookkeeping Burden Than FIFO

By selling off your newest inventory first, you will likely accumulate layers of old stock over time. As a result, you wind up carrying various quantities from multiple purchases and spanning multiple purchase prices. For this reason, it is highly recommended that accounting and inventory-management platforms be used to handle this type of recordkeeping.

Deciding Between FIFO and LIFO for Your Omnichannel Business

Ultimately, only you can decide whether FIFO or LIFO makes more sense for your particular omnichannel ecommerce business.

It is a decision you must make carefully since switching from one inventory accounting method to another requires approval from the IRS, footnoting numerous current and future financial documents reflecting the change, and sometimes even revisions of previous financial reports to reflect the new accounting method.

Not only that, there are also two other common inventory valuation methods to consider that may be more appropriate for your particular business and products:

Specific Identification

Specific identification is a hyper-precise inventory valuation method where each piece of inventory has its own specified cost attached to it. This is useful for sellers with one-of-a-kind items or products that have their individual, trackable serial numbers.

Weighted Averages

Weighted averages can account for the costs associated with commingled inventory purchased at different costs over a period of time. In this model, all inventory is sold interchangeably, regardless of when it was acquired.

No matter which inventory valuation method you settle on, Descartes Sellercloud’s profit and loss (P&L) calculation features can help you keep your books in order. Our QuickBooks integration can make sure you are ready at tax time to report your profits and inventory valuation accurately.

Contact us for a free demo today to learn how Descartes Sellercloud can help you manage your physical and track inventory-related data.