We all want to reduce the costs of services we rely on, such as importing, to provide more competitive pricing to our customers. When shipping domestically, we only have to worry about the cost of the goods in transit—there are typically no additional fees.

However, when importing products internationally, you need to calculate shipping rates, tariffs, duties, and freight, plus any other fees that might be applicable. It can get confusing, especially if you have multiple products to import with different tariffs to pay.

In this article, we’ll discuss the costs sellers can expect when importing from Asia and practical ways they can lower those costs.

What Are the Charges for Importing From Asia?

When importing from Asia or anywhere else in the world, there are quite a few different costs to consider. We can divide the costs of importing from Asia into two main categories: the cost of transporting freight from Asia to the US and the fees, tariffs, and taxes you may need to pay.

Let’s start with the actual transit of freight from Asia to the US. The first thing you must be aware of is that you shouldn’t confuse how shipping rates are calculated and how freight prices are determined. Typically, shipping rates are calculated by comparing the package’s dimensional weight by multiplying its length, height, and width and then weighing the package.

You’ll then get a quote based on whatever they can charge you more for—the weight of the package or the dimensions. The method used to import freight—by air or sea—will change how your imports are charged and what additional fees they may be subject to.

Importing via Air Freight

Flying imports into the US is typically faster than by ocean freight, though there are still plenty of processes that freight needs to go through, which can slow down the process. Air freight is usually charged by ‘chargeable weight.’ This can be the physical weight of the freight or its volumetric weight.

Volumetric weight is calculated by multiplying the dimensions of the freight and then dividing that number by either 5,000 or 4,000. The carrier will then charge based on whichever is higher of the two.

Importing via Sea Freight

Shipping by cargo ship is more common than by air but can incur more fees. When importing by sea, your imports will be charged based on their dimensions or weight. Both of which include packaging and pallets.

As always, the carrier charges according to whichever of the two is higher. If you’re importing a Full Container Load, you will be charged according to the container size and if a specific type of container is needed.

Also worth noting is that many carriers transporting freight across the ocean are part of a shipping alliance. These carriers agree on routes and rates to keep them stable. Therefore, most carriers will offer the same or similar rates for transporting cargo from Asia.

Some of the standard fees incurred by carriers importing in the USA can include:

- Terminal Handling Charges. Also called ‘Container Service Charges,’ these are charges by shipping terminals for storing goods before loading them onto a ship.

- Bunker Adjustment Factor. A fee to compensate for fluctuations in the price of fuel.

- Currency Adjustment Factor. A levy specifically for imports from Pacific Rim countries covers any currency fluctuations while freight is in transit.

- Bill of Lading fees. A fee to release the bill of lading.

- Harbor Maintenance Fee. A charge of 0.125% of the cargo value.

Taxes, Fees, Tariffs, and More

Now, here’s where things can get confusing and often slide out of our control. There are a lot of variables to consider. These additional costs depend on the country from which the product is imported, its size or weight, and whether the product has any preferential status.

Duties (Tariffs) and Taxes

Before discussing taxes properly, we need to explain the ‘Harmonized System’ (HS) and its codes. The Harmonized System is administrated by the World Customs Organization and is used by the US and most of its trading partners to determine which duties and taxes need to be paid.

HS codes comprise the first six digits of 10-digit Harmonized Tariff Schedule (HTS) codes. The numbers in the sequence break down what the product is and what it is made of. HS codes can also tell you if a product qualifies for a ‘preferential tariff’ under any trade agreements (more on that in a second).

When HS codes are checked, an import may be duty-free. In some cases, this may depend on the purpose of the products. For example, you may need to pay customs duty on imported Japanese commercial goods but not for non-commercial goods.

These tariffs are imposed on some products from abroad that are also made in the USA. Tariffs keep US products more competitive because they can be sold cheaper than imported goods. According to the Office of the United States Trade Representative website, the US currently has “a trade-weighted average import tariff rate of 2.0 percent on industrial goods.”

Keep track of tariffs because they change often. For example, in late 2021 and 2022, the US removed several tariffs on EU, UK, Ukrainian, and Japanese steel and aluminum imports.

Duty tax rates range from a low of 0% if duty tax does not apply to a high of around 38%. However, the average rate is often around 5%. When applicable, tariffs on Chinese imports can range from as low as 7.5% to 25% of the value of the cargo.

Customs and Border Protection (CBP) enforces duty rates. Of course, the import duty tax must be paid in USD. There is also an Excise Tax that applies to specific goods such as fuel, tobacco, and alcohol.

Preferential Rates

Several Asian countries are entitled to ‘preferential rates’ under certain circumstances. The first category of countries with preferential rates are those with Free Trade Agreements with the USA. These are Singapore and South Korea.

The Generalized System of Preferences (GSP) also grants developing countries free or reduced importing rates. In Asia, some of the beneficiaries include the following.

- India.

- Indonesia.

- Pakistan.

- The Philippines.

- Vietnam.

- Sri Lanka.

- Uzbekistan.

- Kyrgyzstan.

- Mongolia.

- Syria.

- Myanmar.

- Yemen.

- Timor-Leste.

- Laos.

Other Fees

You may also have to pay a Merchandise Processing Fee (MPF)—also known as a ‘User fee’—payable to the CBP. MPF is an ‘ad valorem fee,’ charged according to value. The CBP charges an MPF fee of 0.3464% on the value of your products.

Lastly, you may pay for insurance in case your goods are damaged or stolen during transit. Insuring more valuable goods costs more.

5 Practical Ways to Save Money Importing From Asia

There are many practical ways to reduce the cost of importing products from Asia. Utilizing these techniques can drastically reduce the burden of importing from across the Pacific.

1. Freight Consolidation

Freight consolidation is necessary for many sellers who import various products from Asia or elsewhere. It ‘consolidates’ multiple imports into one load, saving importers space and speeding up the process. Most importantly, though, it saves sellers money on customs clearance expenses as your consolidated import is charged only once instead of several times if it was several imports.

You can consolidate freight with imports that meet along the way from different origins. For example, if you have an import from Malaysia and another from Vietnam, you can send them to Taiwan and then consolidate them into one import before sending them to the US.

2. Compare Costs Between Different Carriers

Are you using the best carrier to import your products from Asia? While you might not be able to reduce customs fees, you might be able to reduce delivery costs. It might be time to review which carrier you’re using and see if you can find a more affordable rate. Get quotes from several carriers. Some carriers even have import calculators (of course, don’t rely on these to be accurate).

3. Optimize Packaging

Poor packaging can result in damaged products you can’t sell, so it may be worth spending a bit more on packaging to ensure products are safely imported. Too much packaging can also be problematic as it can mean that your products take up more space than they need, which can cost you more.

4. Anticipating Customer Demand

You must be sure that it’s worth importing products and in what amounts. You don’t want to import too few or too many. Too few could be a missed opportunity, and too many can lead to a loss—you don’t want to waste money on storage for a product no one wants. You can then experiment with different import sizes. Could it be beneficial to import fewer or more significant quantities of your product and keep it in inventory?

5. Increase Your Prices

You might not want to increase your prices, but you might not have a choice. If you don’t, you might not make a profit, or it could even lead to a loss. Products with slim profit margins are more at risk of becoming unprofitable to import. So, you may feel that there are no other options. For many sellers, it might be a no-brainer. They may think this is the only way to combat import prices, though some sellers may hold it back as a last resort.

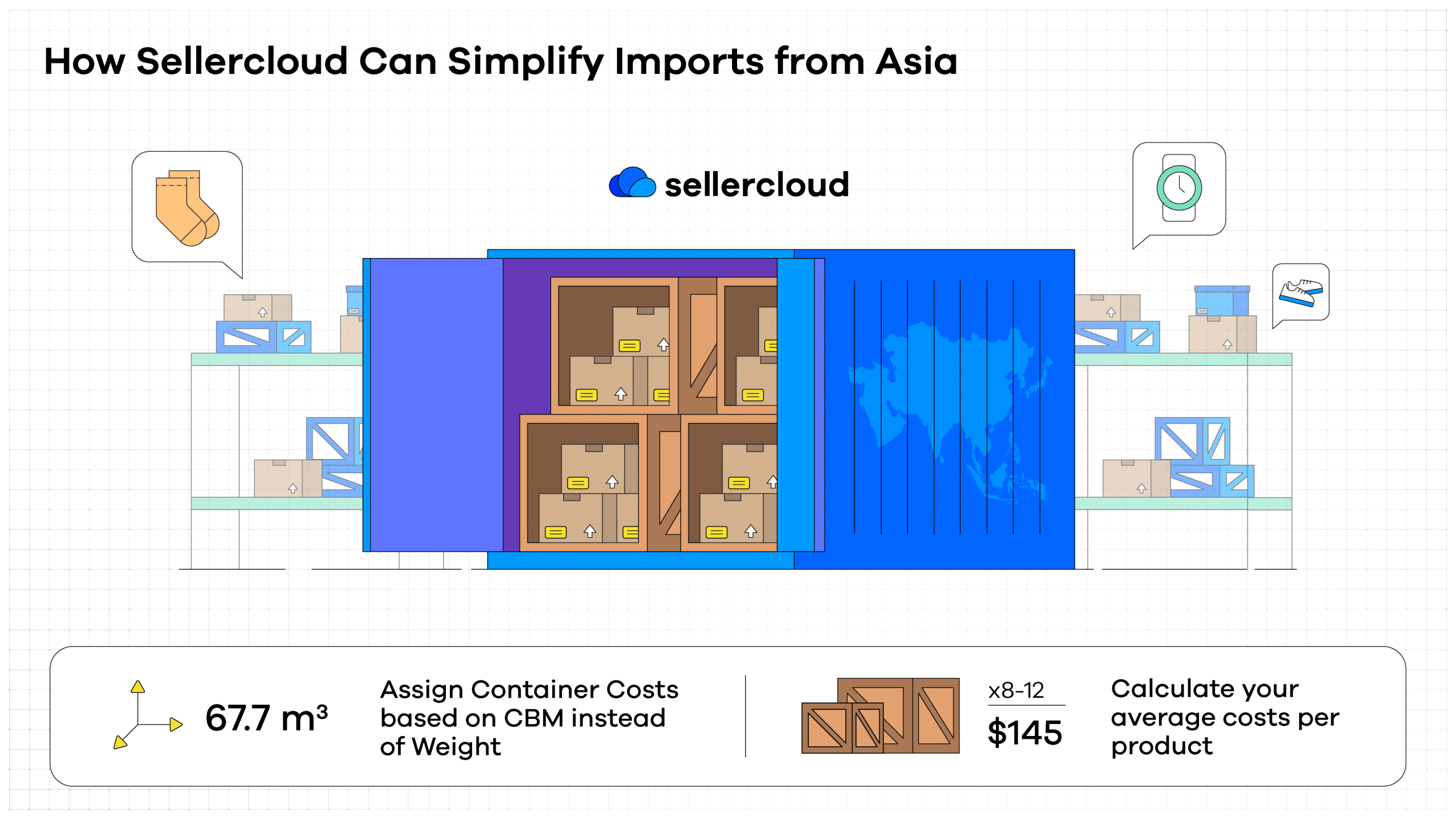

How Descartes Sellercloud Can Simplify Imports from Asia

Descartes Sellercloud is a real solution to your importing woes. Using Sellercloud’s platform, you can assign container costs based on CBM (‘cubic meter,’ also written as m³) instead of weight. You can then easily calculate your average costs per product based on the amount of container space they take and the price of a container.

This is beneficial because small shipments sent by a carrier or postal service are typically charged by weight, while larger imports are charged by the container. But that’s not all. Descartes Sellercloud can also help when importing shipments with several SKUs, each with different import fees.

Imagine you’re importing several laptops, keyboards, and monitors. Each item has a different importing fee, making it harder to calculate the total cost. Descartes Sellercloud enables you to calculate the costs associated with importing and see them adequately for each product you are importing.

Armed with this information, you can better plan your imports, understand the cost of importing a product, and price it accordingly. You’ll know how much profit you can make before it even leaves the port.

Where Does the US Import From in Asia?

The US imports a significant number of products from Asia. The US’s largest Asian trading partners are China, ASEAN, and Japan. Each nation or region has challenges when importing to the US, and it would be wise to consider their differences.

China

China is the US’s largest trading partner globally, even beating neighboring countries Canada and Mexico. In the last few years, issues have arisen between China and the US over trade tariffs. Importers should have a plan if such an event occurs again.

But there is some good news. The Chinese economy is forecast to rebound in 2023, with the IMF projecting that it could expand by 5.2%. This rebound results from China’s reopening to the rest of the world following its relaxation of COVID lockdowns, which has increased trade prospects.

ASEAN

According to the website of the Office of the United States Trade Representative, ASEAN is:

“[C]ollectively the United States’ fourth-largest goods trading partner and together represent a market with a GDP of more than $3 trillion and a population of 667 million people.”

ASEAN stands for the ‘Association of Southeast Asian Nations.’ It currently consists of Myanmar, Thailand, the Philippines, Malaysia, Indonesia, Brunei Darussalam, Vietnam, Laos, Cambodia, and Singapore.

Japan

Japan is another of the US’s largest trade partners in Asia and worldwide. Before China became the powerhouse it is today, Japan was the US’s biggest Asian trading partner and one we historically associate with Asia. ASEAN has also surpassed Japan in exporting to the USA, but a significant amount of trade still occurs between the two countries, particularly in technology and machinery.

What Does the US Import From Asia?

According to data from the World Integrated Trade Solution (WITS), in 2020, the US imported over $900 billion worth of products from East Asia and the Pacific region. Of that, the largest quantity was categorized as ‘Mach and Tech,’ which constituted almost $4 billion, nearly half of the total amount of imports.

Interestingly, the US also exports an enormous amount of products to East Asia and the Pacific, totaling approximately $400 billion, according to WITS’s data. And again, ‘Mach and Tech’ was the most significant import, worth approximately $120 billion.

The Costs of Importing From Asia Are Tied to International Trade

According to data from Trading Economics, US import prices rose in 2022, although they appeared to cool toward the end of the year. The 2022 rise was particularly apparent between February and March and peaked in June. Historically, US import prices have gradually increased, though the change in import prices has been more volatile since 2008.

It perhaps suggests that we can continue to expect price increases and additional volatility in the years to come. There has also been a lot of talk about a potential recession in 2023. Meanwhile, a superb article by Oliver Telling, Valentina Romei, and Richard Milne of The Financial Times in February 2023 sees a more complex period brewing on the horizon.

In short, they say carriers have an “overcapacity problem,” which has led to the price of shipping goods on vital global trade routes falling by 85%. They believe that the reason for the price fall is the cost-of-living crisis. Inflation has led many to spend less on goods, reducing demand and lowering shipping prices.

This has been further compounded by the demand for container space soaring during the pandemic, especially in 2022. Many carriers invested in new ships to increase their capacity, but this additional capacity is not in demand in 2023. To combat oversupply, carriers may start cutting down on capacity to increase prices.

Book a Descartes Sellercloud demo today.